Housing Market Update

The US housing market has suffered through 3 tough months due to the pandemic, but it appears to have not only healed, but is ready to grow during the last 6 months of 2020 and into 2021.

Read the list of key factors driving market predictions below. What’s important to know about the summer real estate market is that home buyers are very active and eager, a migration trend is happening, wages are rising and consumers are spending during this work at home, stay at home, pandemic period.

Buyers see great value in owning real estate right now and they’re willing to pay higher prices.

A number of economists and housing experts have loudly predicted a housing market crash, but their gloomy forecasts simply haven’t taken hold. The housing markets have continued to thrive. Real estate is the new gold, even if gold itself has risen finally. And if you’re a Realtor, you should be positioning yourself at the top of seller’s mind with some innovative real estate marketing packages.

Fall Season Worries

We may have outbreaks or a surge in this fall’s back to school and indoor season, but we’ve had that this summer too and housing sales have done well. Only another shutdown could stop people from buying real estate. With Covid 19 infections receding in Florida and Texas, it’s easier to understand a positive housing market outlook.

Typically, at the end of recessions mortgage rates drop and the housing market begins to thrive. The economy was going gangbusters back in February with a booming stock market. Stock markets continue to surge upward, as the US economy rebuilds and moves into 2021.

More Factors Positive and Fewer Negative

There are many trends driving house sales right now:

-

- young millennials forming families

- work shutdowns have eased

- low supply of housing

- new construction surging despite home blocking regulations

- ultra low mortgage rates heading lower

- migration of people outward from high density areas and high density housing to suburban and rural regions

- huge amount of personal savings earning very low interest

- work at home requiring a new living space with perhaps an office

- stock market rocketing adding confidence to home buyers

- baby boomers waiting for the perfect time to sell their home

- urban crime aiding in pushing people out of the big cities

- corona virus still a big threat in transit, retail shopping, schools and workplaces

- looming election that could see President Trump lose

- democrats if elected would raise taxes and launch a recession

- President Trump enacting orders to continue eviction moratorium and provide further income assistance which could be continued through to 2021

- a vaccine by 2021 is likely to happen

- consumer spending is rising

Home buyers and sellers are weighing many of these factors and it does impact house prices.

July 2020 Housing Data Preview

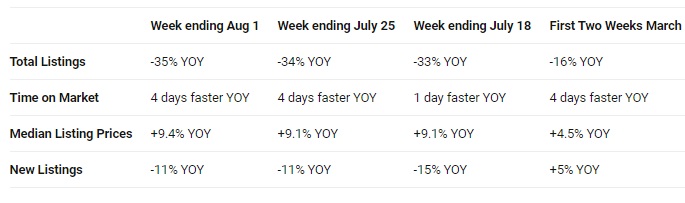

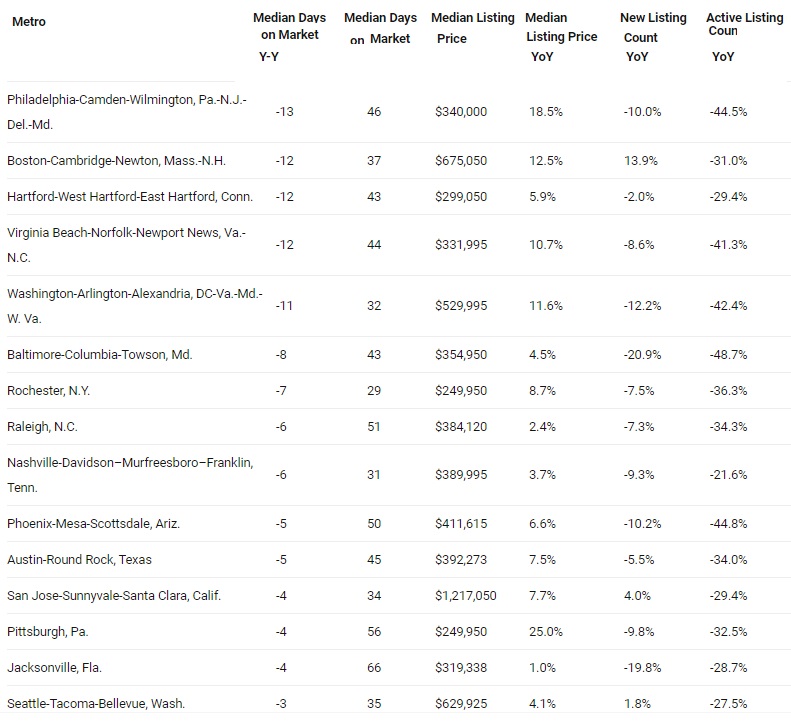

For the week ending August 1st, Nar reports faster rising prices and fewer homes for sale. The data is a natural progression of the June housing data. July’s data will be released in late August.

Early Look at July 2020 Home Sales Data

Realtor.com recent home sales data for July 2020:

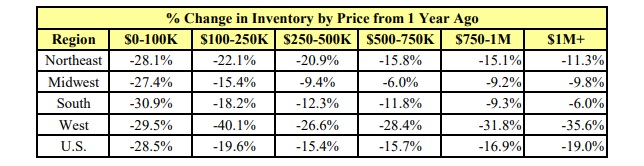

- US home inventory declined by 32.6% YoY

- home inventory in major metros fell by 34.8% YoY

- inventory of newly listed properties fell 13.4%

- inventory of new listings fell 13.4% in major metros

- median home listing price rose 8.5% to $349,000 YoY, while homes prices rose 7.8% in larger markets

- days on market dropped to 60 days in July, the same as last year.

US Home Sales June 2020

In June 2020, NAR reported a strong growth in sales and prices in most regions of the country.

NAR stats showed sales of single-family homes, townhomes, condominiums and co-ops rose 20.7% in June from May to a new level of 4.72 million sales. As amazing as that was, it is still down 11.3% from 12 months ago (5.32 million in June 2019).

Sales of single-family home sales rose 19.9% to 4.28 million in June, from May’s total home sales of 3.57 million. That June sales number is still down 9.9% from one year ago. In June, the median existing single-family home price came in at $298,600, which was 3.5% from June of 2019.

Existing condominium and co-op sales rose 29.% to 440,000 units in June. That was still down 22.8% from June 2019. The median existing condo price rose 1.4% to $262,700 in June. Although condos sold much better, it’s apparent the demand for high density and multifamily dwellings has diminished.

Lawrence Yun NAR’s chief economist of the National Association of Realtors says “The sales recovery is strong, as buyers were eager to purchase homes and properties that they had been eyeing during the shutdown. This revitalization looks to be sustainable for many months ahead as long as mortgage rates remain low and job gains continue.”

Chief Economist Danielle Hale discusses the latest jobless claims as well as the July jobs report.

Home Prices June

The median resale home price for all housing types in June was $295,300. That was a rise of 3.5% from last June 2019 ($285,400. The home price growth was the 100th straight month of year-over-year gains.

At the end of June, total resale home inventory was 1.57 million units. That is up 1.3% from May, yet is 18.2% lower than 1 year ago (1.92 million). Unsold inventory fell to a 4.0 month supply which is well down from 4.8 months in May.

There you have the big three stats which will point us to much higher prices in July and August. The 3 month outlook is positive given the return of the economy and rising job numbers.

Obviously the economy has some ways to adapt to the pandemic threats, but over time, displaced workers will move on to new industries. If jobs are brought back from China, given the growing US China disputes, demand for US manufacturing will be intense. It should give the stock market and American investors big confidence.

Improving Strengthening Economy

The improving economy will drive more sales, more new home construction and and US manufacturing will surge to due to US blocking of China imports. This last factor could generate tremendous economic growth and capital investment across the US.

The Commerce Department jumped 8.2% last month which was the highest increase since the statistic has been tracked. Wages rose 2.7%. The savings rate has dropped 9% from May, which means Americans are spending their savings. However, new home construction sales are up, used car sales were up, and stock market investing is up.

And Houzz.com said home renovation is booming, with a 58% annual increase in project leads for home professionals in June. Kitchen and bath renos are up 40%. And Poolcorp, an international distributor of swimming pool supplies, parts and outdoor living products saw its stock rise 54% due to increased sales. The new trend during this hot, stay at home summer is a swimming pool.

The point is that consumers are spending, just not on traditional products because this spring and summer are not traditional times.

It’s clear that consumers are spending and putting some rainy day funds into play to help us through perhaps the toughest 3 months the US has ever experienced.

See more on US housing market forecasts. for cities including New York, Boston, Atlanta, Chicago, Los Angeles, Denver, Dallas, Seattle, Houston, San Diego and the Bay Area and Florida. Realtors, looking to grow your visibility, draw leads and grow sales? Check out marketing services for Realtors.

AI Marketing | AI Marketing Companies | Marketing Package for Real Estate | SEO Services | AI SEO Software | SEO Software Platforms | AI Sales Software | AI Predictive Analytics | AI Marketing Tools | Marketing Services Toronto | Marketing Services Boston | Marketing Services Los Angeles | Marketing Services Bay Area | Marketing Service San Diego | Why Use AI Software? | What is AI Marketing? | AI Stock Forecasting | AI Writing Software | AI Marketing Agency